ICYMI: Startup news and resources from the week that was

What you might have missed last week on Caffeine.

Welcome to Monday!

As always, on Monday we recap a few of our favorite stories or resources from the week that was then tomorrow kick back into our full newsletter from Tuesday.

But to make sure you have at least some fresh content, help yourself to a new series of AMA answers from our friends over at BNZ unpacking everything you asked about fintech.

Have a great start to your week,

Finn and the Caffeine team

Meet Jacob, BNZ’s guru in FinTech Business

What is "tech banking" and how is it different from regular business banking?

It requires the bank to align its mindset, products, and risk frameworks with the unique growth patterns of tech companies. Instead of relying solely on past performance, tech banking focuses on forward-looking indicators, such as recurring revenue, net revenue retention, customer acquisition cost, and market potential (to name a few). It is about looking beyond just profitability and understanding the industry well, so bankers can detect and articulate the company’s value beyond financial statements alone.

But it isn’t just about providing capital. Banks serving tech companies need to support their global ambitions from day one, which means supporting foreign exchange and understanding the complexities of operating in multiple jurisdictions at an early stage.

In short, tech banking means taking an approach to providing capital that reflects the business model, supporting with valuable industry connections, and applying the expertise needed to help businesses scale and grow fast.

What's the difference between tangible and intangible assets, and why does it matter for tech banking?

Tangible assets are physical items a business owns – such as buildings, equipment, stock or vehicles. They are relatively easy to value and can form part of the security for bank lending. Tangible assets are familiar to banks and have been used as a collateral for many years.

Intangible assets are non-physical but can be just as valuable. in many cases more so. Things like software code, customer databases, intellectual property, brand, patents and customer contracts. The potential subjectiveness of intangible asset valuation has historically made it hard for banks to use these as security.

For many tech businesses, these intangible assets are where most of the value sits, so we’ve had to evolve our approach. Banks will differ, but BNZ’s approach recognises intangible asset value, particularly when backed by strong tech metrics. This approach has enabled us to lend to tech businesses where we previously couldn’t.

How has the banking landscape changed for funding tech businesses over the past decade and how does this help me as a tech startup?

Banking systems and processes have been around for decades, built on accounting standards and finance practices that date back to the 1970s. Generally speaking, they haven't been updated a lot since then mostly because they are effective. However, as business models have evolved, particularly in tech, this has made it harder for startups to access the kind of funding they need in ways that work for them.

In response, BNZ has opened up non-dilutive financing options to thousands of tech businesses – funding that gives them access to capital without giving up ownership or shares in their company. It's about designing banking around how tech businesses actually operate, rather than forcing them into traditional frameworks that don't always make sense for them.

The banking landscape has changed and continues to shift in favour of technology industry business models. Tech banking is more than just providing capital – it’s about providing a broad range of support that enables tech businesses to grow. We welcome any feedback or thoughts on how we can do more.

How to build a team around a product

By Kathleen Webber, LiveRem co-founder

There’s a well-worn playbook in the startup world: come up with a great idea, pitch it, raise capital, and build your team with someone else’s money. That sequence is so ingrained, it almost feels like the only way.

We didn’t do that. In fact, we never planned to.

From the outset, we wanted to build LiveRem without venture funding. That wasn’t a philosophical stance as much as a practical one. We didn’t want to answer to investors before we’d even proven the product, the business model, or the scale of the opportunity. We also acknowledge our privilege in being able to do that. We have another business that could sustain the early bootstrapping period, giving us the breathing room many founders don’t get.

That breathing room wasn’t unlimited though. We still had to be incredibly deliberate with every dollar. And that shaped the way we thought about building our team.

Designing the team before building the product

After completing our first product sprint, a somewhat loose interpretation of the Google Design Sprint process, we had clarity on what LiveRem should be. The product made sense. The customer needs were clear. But the leap between a validated concept and a functioning product is always the hard bit.

We didn’t have a team. We didn’t have a war chest. And we knew that building a permanent, salaried team the traditional way was off the table if we wanted to stay lean.

So we flipped the question. Instead of asking, who can we afford to hire full-time?, we asked, what is the minimum expertise we need to deliver this product well? And from there, how do we access that expertise without the cost burden of permanent headcount?

That thinking led us to build a 100 percent fractional, remote team. A collection of highly capable people, working with us part-time, brought in specifically for their expertise. Some of our team are seasoned professionals at the top of their field. Others have retrained into their roles, bringing a depth of experience from previous careers.

What they all have in common is that they’re adults. Experts. People who don’t need hand-holding, who don’t need a manager checking in on them every day, and who are driven by the work itself, not by KPIs or clock-watching.

Finding the right people

We didn’t post job ads. Instead, we started with our networks, people we’d worked with, respected, or been recommended. When that wasn’t enough, we tapped into founder circles, trusted introductions, and niche industry communities.

The thing about hiring fractionally is that the bar is higher. You’re not just looking for skill, you’re looking for people you can trust to be autonomous. Someone who knows their craft so well that even if they only work five hours a month with you, those five hours count.

We also ran a bit of a test on ourselves. When we brought people on, we’d often start them on a small contract — ten hours to prove themselves. That was enough time for us to see if they were as good as they said they were, and whether they could deliver without needing constant direction. It was also enough time for them to see if they wanted to work with us. It’s a mutual test, and it keeps the stakes low in the early days.

How we operate day to day

When people hear that our team is entirely fractional, the immediate assumption is that we must run some highly structured, asynchronous communication model. But the reality is far simpler. We work on email, and that’s about it.

Each team member knows the outcomes they’re accountable for. If they need help to achieve that outcome, they’re empowered to reach out directly to whoever they need, whether it’s the CTO, the product and UX lead, or a developer. We don’t require cross-functional meetings to get things moving.

We have a fortnightly check-in where the whole team comes together. But it’s not a status update parade. It’s a space to re-anchor around the bigger picture, raise any blockers, and ask the questions that don’t fit neatly into an email thread.

Beyond that, we operate on a philosophy of forgiveness, not permission. Every team member knows how much we, as founders, earn. That’s deliberate, it gives them context to weigh up decisions. They’re trusted to ask themselves: will it cost the business more to ask for permission, or to just make the call?

Of course, there are boundaries. Any decisions involving customer data need explicit sign-off from the CTO or myself. But if it’s a UI tweak, a product iteration, or a marketing shift, they have the mandate to collaborate with the relevant team member and make it happen.

The reality, of course, is that sometimes things aren’t done exactly how you’d want them done if you were doing it yourself. That’s part of the deal. But you have to trust that your way isn’t necessarily the right way. Just because it’s different doesn’t make it wrong. In fact, more often than not, different means better.

When you’re funding a company out of your own pocket though, watching people make decisions in ways you wouldn’t have can be an... interesting experience. But that’s the price of high trust. And so far, it’s been worth it.

And when you’re bootstrapping, that kind of scrutiny applies to everything. You have to weigh up the cost versus the outcome of every single thing you do, including your people. That doesn’t mean paying them less. In fact, we often pay above market rates for the expertise we need. But it does mean every cost has to be justified by the outcome it delivers. If the value isn’t there, it doesn’t stick around.

Building a different kind of culture

This isn’t a traditional team, so it doesn’t have a traditional culture. There are no weekly quizzes, no virtual drinks, no company playlists. Our culture is built on mutual respect and a shared standard:

● Be great at what you do

● Communicate clearly

● Treat others with respect

We call it the lowest acceptable standard of behaviour. It’s not glamorous, but it works. When you have a team of highly capable people working across time zones, roles, and varying capacities, you don’t need a curated vibe. You need clarity and trust.

But let’s be honest, this model isn’t for everyone. Some founders thrive on building culture through rituals, connection, and energy. If you need that, this can feel sterile, even lonely. It works for us because of the stage we’re at and the way we operate, but it’s not a universal playbook.

The trade-offs

There are downsides. Sometimes progress is slower than it would be with a full-time team. There’s less immediacy when you’re not the only thing on someone’s plate. And yes, it can be lonely as a founder, there’s no daily camaraderie, no team energy to feed off.

But the upside is that we’ve built a business that can flex with demand. We don’t carry unnecessary costs. We’ve maintained profitability without external funding. And when we need to, we can scale, not just by throwing people at the problem, but by engaging the right people for the work that matters.

Would we do it again?

Absolutely. This model has given us freedom to build the business we want, on our terms. At some point, we may bring some of these roles in-house. But that’ll be a choice made from strength, not desperation.

Because the reality is, you don’t need a big, expensive team to build something meaningful. You need the right people, the right incentives, and the trust to let them do their best work.

In the next article in this series, I’ll share how we’ve bootstrapped and grown LiveRem without taking venture capital, what we’ve learned about sustainable growth, how we’ve funded key stages, and the moments where, despite everything, we did consider raising a round.

Aether raises $3.8m to inject AI into marketing presentations: Talk about coming out swinging. Our friends and neighbours over at New + Improved launched their first venture the very night they debuted at last week’s showcase.

Aether helps large organisations solve three pervasive issues: institutional amnesia (where valuable data insights are lost or under-utilised), wasted productivity on repetitive research production, and outdated information embedded in static decks.

The company’s software integrates live data directly into presentation and document workflows, eliminating the manual copy-paste grind that can consume up to 40% of marketers’ time.

Once plugged into data sets, Aether creates customisable presentations using a business’ branding within minutes and allows them to be effortlessly updated as the underlying data is refreshed.

The company has a very strong start, with a $3.8m seed round led by Icehouse Ventures, with additional backing from Brand Fund 2. Aether has already secured contracts with major enterprise customers across Australia, New Zealand, and the U.S.

Already generating over $600,000 in annual recurring revenue, Aether is seeing rapid adoption among large-scale marketing teams where inefficiencies are most acute.

“They say measure twice, cut once, and this should also be true of marketing workflows. As it stands, most slide decks are recut every time a presentation happens, wasting valuable resources from internal teams,” said Carsten Grueber, Co-founder and CEO of Aether.

“Aether transforms presentations from static documents into living, connected assets that are accurate, always up-to-date, and ready to share. Instead of marketers spending half a week building the monthly performance report, they can spend that same time doing the actual marketing itself,” said Grueber, who was formerly Country Manager of TikTok New Zealand.

The Powerpoint industrial complex is vast, powerful and ripe for disruption. Think about how many jobs in the world have huge amounts of drudgery baked in because they boil down to laboriously constructing slideshows, more focused on the the labour of building them than actioning the data represented in them.

Congrats to the team and can’t wait to see how far you take this one.

Event: I Wish I Knew with Penelope Barton - Join us for cocktails and a raw and real conversation with a successful Kiwi operator Penelope Barton from Crimson Global Academy, who has taken hits, made calls, and kept showing up. This is about the stuff they wish they knew earlier – the kind of lessons that only come from doing the work (and a few things going sideways).

This event is for founders and we are only allowing one person per company, due to it being an intimate event. We screen all registrations to make sure appropriate criteria is met.

Meet Vanta

Vanta are the legends behind the world’s first enterprise-ready trust management platform - helping businesses nail compliance, scale security and build trust all in one place.

Big thanks to Vanta for backing our next 'I Wish I Knew' networking night.

Date and time

Mon, 1 Sep 2025 5:30 PM - 7:00 PM NZST

Location

Dr Rudi's Rooftop Brewing Co.

Get your tickets and check out more details here

95% of AI pilots are failing - MIT Report: A bit of research providing red meat for the ‘A.I is overhyped’ crowd this week was a new study from MIT which found while billions are being poured into integrated enterprise applications of A.I, only 5% were actually returning millions in value while the vast majority contributed no impact on profits at all. The study points to the current brittleness of agentic AI and its inability to adapt on to context and learn from previous experience in the same way an entry level human can. I think research like this is an important pinch of salt for A.I doomerists (of which I can definitely be one, on occasion).

However, I think the failures of A.I pilots will often stem not from an underlying failure of the model’s capability but it being put to the wrong purpose by its managers. Every new technology has a learning curve before enterprise at large finds the best way to implement it and I would argue we are at the bottom of a hockey stick curve, not at the top of an A.I bubble.

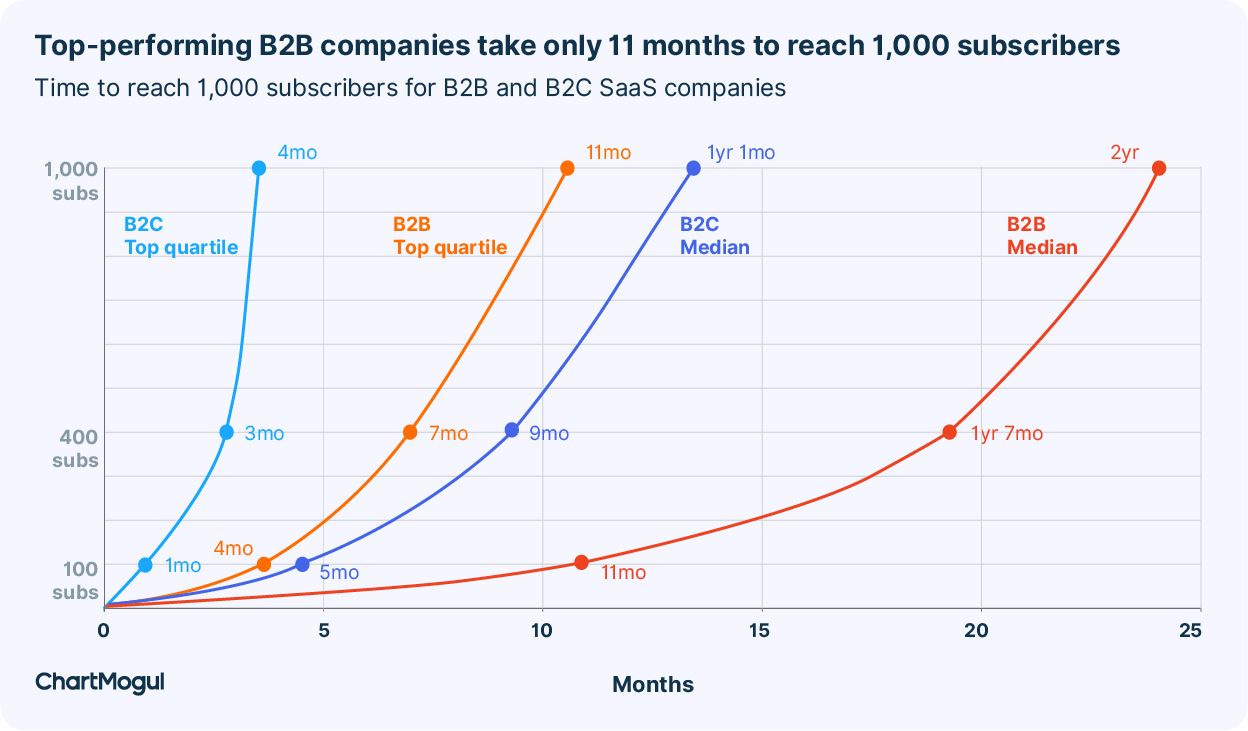

We love finishing on a chart here at Caffeine at the team at ChartMogul have a stack of them in their SaaS Go-To-Market Report, where they analyze how 2,500 SaaS companies acquire and convert customers.

A few key insights below.

Top-performing B2B companies reach 1,000 subscribers in just 11 months, while the median B2B company takes 2 years.

Embracing full PLG at lower price points can grow new business faster. At low price points, adding sales creates friction. Companies that stay self-serve grow faster.

Starting at a $100 ASP, most B2B PLG companies begin layering sales on top of PLG. Adding sales helps buyers make decisions as products and purchase processes become more complex.

Trial-to-paid conversions spike around day 7 for both PLG and SLG companies. No matter the GTM strategy, success comes from getting users to reach the 'Aha' moment fast.

Discounted subscriptions often follow similar timelines to full-price ones. At lower ASPs, they can even take a bit longer.

Check out the full report for yourselves here.

Want to get in touch with a news tip, a slice of feedback or just to chat? Email hello@caffeinedaily.co