ICYMI: Startup news and resources from the week that was

What you might have missed last week on Caffeine.

Welcome to Monday!

As always, on Monday we recap a few of our favorite stories or resources from the week that was then tomorrow kick back into our full newsletter from Tuesday.

Have a great start to your week,

Finn and the Caffeine team

Sudden visa changes rattle US-NZ pipeline: ‘Think about the US from day one’ is something you often hear in this world. Cracking the US can put your growth on the kind of hockey stick curve that startup dreams are made of but sudden changes implemented by the Trump administration have potentially put at least one path to the US out of reach.

A wild $100,000 USD ($170,000NZD) fee was summarily slapped on the H-1B, a popular US work visa which allows highly skilled workers to live and work in the US for three years( renewable once). It seems to be a play by the Trump administration to ensure businesses are incentivised to hire local workers into key growth areas but like so much coming out of the US currently, there was a lot of confusion about the roll out.

For a while it seemed as if the fee might apply to existing holders which would have upended many Kiwi founders who have already made the jump using H1Bs but it has since been clarified that it will only apply next to new applicants on the lottery next year. Kevin Park, co-founder of new Crimson Education spinout Concord Visa and man with a very well timed new business specialising in this exact area was on RNZ yesterday breaking it down and would recommend listening here.

He reminds people not to panic and believes this will be resolved with ambitious Kiwis still finding their path to the US. He also notes there are other visa options which get less attention than the H-1B, like the O1 path for those with ‘extraordinary ability’ - which is all you reading this, obviously.

Event: Auckland Startup Week approaches - I feel the passage of time very acutely as I write this sentence but Auckland Startup week arrives is less than a month. I swear I was covering its announcement back in 2024 like, two weeks ago max. It’s about dam time we had something like this in Auckland (not just because I’m from here) but because there is a huge amount of untapped talent and capital here that’s just waiting for the right connection to be made. Startup Week Auckland kicks off from October 20 and is packed with cracker events to help founders on every stage of their journey. There’ll also be some familiar faces there (make sure to check out resident scribbler Serge Van Dam at the Movac Leadership Jam on Wednesday Oct 22) and check out the full calendar of events and get your spot at them here.

Pod Pick: Investing in the grey zone of dual use technologies - If the AI bubble bursts, this might be why: It’s Thursday and Thursdays are where you guys let me ramble about something interesting on the global stage for a minute (I’ve decided, not very democratically) so bear with me a minute while we talk about data centres.

We’ve covered the future of data centre roll out in New Zealand here on Caffeine before, with 56 already here and 20 more under construction. Together, they’re enabling $16.5B in ICT GDP and supporting a further $76.5B in knowledge-intensive industries. We’re deploying $10 billion in NZ to build more of them over the next decade, while globally the spend could reach $7 trillion by 2030. As McKinsey points out in this report, half of that spend goes into ‘Server costs’, which is largely made up of buying the physical GPUs which stack into those servers.

When you look under the hood of headline economic numbers globally right now, it’s shocking how much of worldwide growth is being driven by spend in AI, the majority of which is capex spend in data centres. It’s what’s taken Nvidia to being the world’s most valuable (and arguably geopolitically important) company.

Bu this means the world economy is a growing Jenga tower stack balanced increasingly precariously on a shrinking number of blocks. This is the ‘mother of all bubble’ arguments we’ve all heard before. I would argue we’re almost certainly in a bubble but that doesn’t mean the technology isn’t transformational.

The internet created its own bubble. The rail roads created multiple bubbles. A technology being a bubble isn’t mutually exclusive with a technology being transformational - they often go hand in hand.

The thing I hadn’t considered until listening to this podcast by Derek Thompson (formerly of the Atlantic, now a Substack native) is how different the underlying capex spend is on data centres vs railroads or fibre optic cables. Namely, GPUs depreciate in value shockingly fast so companies need to somehow recoup this spend very quickly.

If I spend a few million on laying fibre lines or even billions on laying railway lines, those lines can be used almost identically in 5 years time. If I build a data centre using the latest Blackwell GPUs from Nvidia, those will be worth a fraction of my spend in very short order and will all have to be replaced. It’s such a basic thought with fairly profound implications for our current economy which is increasingly being propped up by this gargantuan bet on building bigger and bigger data centres.

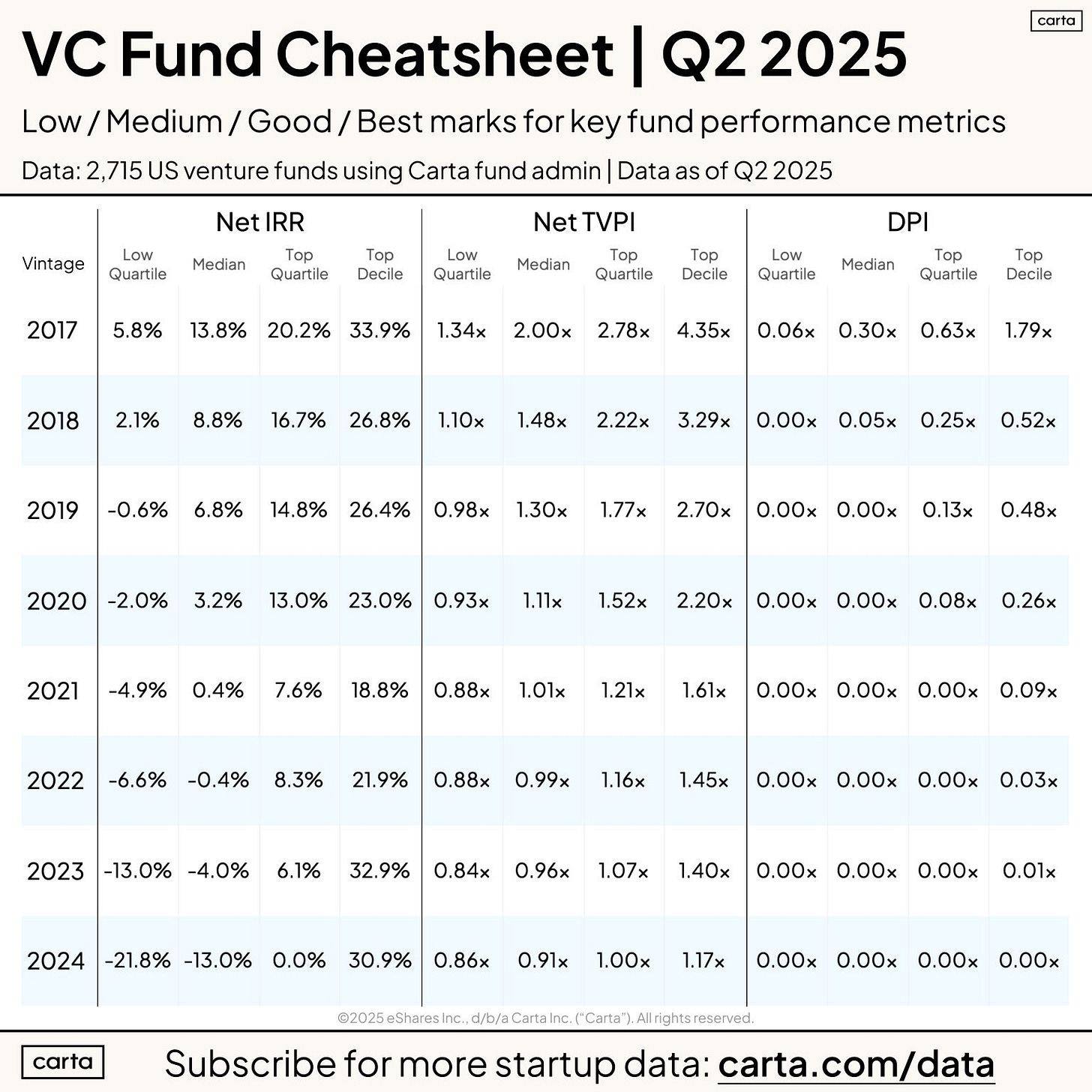

A nice data dense parting shot courtesy of the excellent team at Carta who have just dropped their VC Fund Performance: Q2 2025 report. Check out the full report here or some key highlights below. Peter Walker, their head of insights, is an absolute gem for always breaking down the numbers clearly.

Highlights from the report:

Key performance metrics are on the rise: Median net TVPI increased at every fund vintage from 2017 to 2023 in Q2. In other words, the value of the typical venture fund inched up. For the 2017 vintage, median TVPI rose to 1.95x. Net IRRs also mostly trended up in Q2, with the median for the 2017 vintage climbing to 13.5%.

Average LP check sizes have grown: Among VC funds with between $1 million and $10 million in commitments that were raised from 2018 to 2021, the average LP check size was $127,000. Among funds of that same size that were raised more recently, from 2022 through 2025, average check size rose to $165,000. This same trend of larger checks from 2022 on holds true for funds up to $100 million in size.

Dry powder is drying up: Most VC funds raised prior to 2021 have little dry powder remaining. Funds in the 2020 vintage, for instance, have just 11% of their total committed capital still available to invest. More recent funds are also deploying capital quickly. Funds in the 2023 vintage have 42% of their cash in reserve, while 33% of capital from the 2022 vintage remains as dry powder.

Want to get in touch with a news tip, a slice of feedback or just to chat? Email hello@caffeinedaily.co