Your PayTech questions answered + Hiringa Energy wins big across Tasman

Plus: USA unveils a beefy A.I strategy and check out a midwinter event on how to manage when things seem unmanageable.

Happy Thursday!

Kia ora Caffeinators, hope everyone is wrapped up warm this icy morning. Slightly shorter newsletter this Thursday but to make it up to you fine folks I will be releasing another bonus Daily Shot tomorrow to usher you into the weekend right.

Here’s what’s brewing in your Daily Shot:

Meet Joe, BNZ’s PayTech legend

Hiringa Energy wins big across the Tasman

USA unveils national A.I strategy, which unlike ours, will have massive consequences

Event - Mid-Winter Webinar 2025: How do you managing the Unmanageable Without Imploding?

Meta is researching a wristband which can control devices through gestures

As always, thank you to everyone who has upgraded to a paid subscription or simply recommended Caffeine to friends and whānau. We couldn’t do any of this without you.

Finn and the CAFFEINE team

Meet Joe, BNZ’s PayTech legend

This week, Joe Rastrick, BNZ’s Head of PayTech and Emerging Payments, answers your questions on the topic of PayTech. If you want to know more, or simply want to have a chat, reach out to Joe directly on joe_rastrick@bnz.co.nz

Why should we care about open banking?

Banks and other financial institutions hold lots of interesting information about you – like your personal information, spending habits, or your cash in-flows. This information is held securely by your bank and might benefit you directly – like helping you understand your spending habits, or indirectly through organisations that design goods and services for your benefit (who, with better data, could personalise and tailor their goods and services to your benefit).

Open banking is a framework for securely sharing information and data (with your permission) in and out of banks. I would encourage you to care about the security and use of your personal information and data, something banks are highly conscious of.

New FinTech offerings to suit your wants and needs is one interesting use of open banking, but the breadth of potential uses is much broader, from big global tech businesses to local retailers.

Why do some people talk about open banking and others open data?

They are effectively one and the same, though open banking is limited to the finance sector, while open data is broader – all data and all sectors.

By ‘data’, we’re referring to any information that belongs to you or your business, how you use it, and how you let third parties use it for you. Up until this year, we’ve had an industry-led approach to open banking in New Zealand, through a framework set out by Payments NZ (an organisation owned by the banks), with milestones set for all banks (by themselves) to reach by certain dates.

We now have New Zealand’s version of Consumer Data Rights, called the Customer Product Data (CPD) Bill. This Bill tackles all open data at a regulatory level, and this includes open banking, but isn’t limited to it. It will tackle the banking industry first, but will extend beyond banking to any industry that has your data, giving you the rights to that data and what is done with it.

Consider the energy industry and having greater visibility of how you use power and when compared to what power costs at different times.

The industry approach has delivered open banking to New Zealand, and the CPD Bill will accelerate it. Two key benefits of the Bill are speeding up the development of open banking and standardising the API standards across banks, which effectively makes it more cost-effective for FinTech businesses and others interested in bank data to get access to and utilise data.

Payments are near real-time now. What are the benefits of new technology in payments?

New Zealand’s traditional payment network and banking system has been relatively good, meaning innovation in this space was somewhat late to arrive in New Zealand versus other countries. There was less need of it here compared to other countries, like India’s move from largely cash to a Unified Payments Interface (UPI) or the UK’s Consumer Data Rights (CDR), pushed by lack of trust in traditional banking after the Global Financial Crisis.

Payments move value (money) from A to B with data (e.g. payer and recipient details, references, countries, what it’s for, etc). The important part of this innovation is not the movement of value, but the data behind it.

Knowing your customers’ transactional data allows business to make customer offerings and experiences more personalised, which in turn builds trust and loyalty. It also means businesses can make more informed data-based decisions around what they supply, when they supply it, customer behaviours – they know what their customers want and when.

The payment technology should be largely unseen and deliver speed. People care less about how they pay. What they care about is the service, the purchase and the experience.

If open banking is already so advanced in the rest of the world, why innovate in New Zealand? Why not just adopt global?

Great question! I truly believe the can-do attitude of people in New Zealand means that we can create here, test it, learn, and then go global.

Open banking is already advanced in many other countries, but that is the opportunity for the creators and innovators here – to localise or develop better and deliver stronger global solutions.

Going first in other countries does not necessarily mean developing the best solutions. There are lots of lessons from other countries which New Zealand can pick and choose from. Many leading countries in this space are going through a refresh of their frameworks (to improve their first go at it), which gives New Zealand innovators the opportunity to scale into those markets.

We also have unique data sovereignty to think about here, ensuring the inherent rights and interests that Māori have in relation to the collection, ownership and application of their data. This allows us to think about open data differently, that could be very attractive to other countries looking to solve similar problems.

At BNZ, we want to support these innovators by ensuring they have what they need to develop the next best payment evolutions here, then take them to the world.

This article is solely for information purposes. It’s not financial or other professional advice. For help, please contact BNZ or your professional adviser. No party, including BNZ, is liable for direct or indirect loss or damage resulting from the content of this article.

Hiringa Energy wins big across the Tasman: Our friends over at green hydrogen startup Hiringa Energy have notched up a great win in Australia in their mission to unlock the true potential of green hydrogen. Since 2016, Hiringa has been developing low-carbon hydrogen production projects to supply industry, agriculture and transport. Now, Hiringa Energy, Sundown Pastoral Company and the NSW Government announced Financial Close on their Good Earth Green Hydrogen and Ammonia (GEGHA) project, with construction scheduled to begin in October this year.

The GEGHA project is an integrated solar energy to low-carbon hydrogen and ammonia operation. Once complete the plant will be located adjacent to Sundown’s Joint Venture Wathagar cotton ginning facility, near Moree NSW.

GEGHA will produce up to 4,500 tonnes of low-carbon ammonia annually, displacing high-carbon fossil fuel-based nitrogen fertilisers and removing up to 17,000 tonnes of CO₂-equivalent emissions each year – the same as taking 6,500 passenger cars off the road or planting half a million trees.The facility will supply ~224 tonnes of green hydrogen per annum for direct use. Green hydrogen is set to be consumed as part of Hiringa’s heavy-vehicle refuelling network, as well as on-farm to displace diesel in irrigation pumping, further decarbonising the agricultural supply chain from paddock-to-port.

Congrats to the team!

USA unveils national A.I strategy: Much like New Zealand, the US has now published a National AI Action plan to provide a roadmap to the nation’s strategies and priorities for the technology which will define all our lives. Unlike New Zealand, their one says quite a lot and will be critically important to how this technology is built.

However the two plans do share a spiritual backbone in that they are both focused more on speed than on safety. Trump’s plan is about building out infrastructure, cutting red tape and competing with China more than it is pumping the breaks and building out the technology slowly. The full plan is available here but I’ve put the subheadings for each aspect of the plan below and I think you can get a good sense of priorities just by the order they come in.

Ensure that Frontier AI Protects Free Speech and American Values

Encourage Open-Source and Open-Weight AI

Enable AI Adoption

Empower American Workers in the Age of AI

Support Next-Generation Manufacturing

Invest in AI-Enabled Science

Build World-Class Scientific Datasets

Advance the Science of AI 9

Invest in AI Interpretability, Control, and Robustness Breakthroughs

Build an AI Evaluations Ecosystem

Accelerate AI Adoption in Government

Drive Adoption of AI within the Department of Defense

Protect Commercial and Government AI Innovations

Combat Synthetic Media in the Legal System

TechWomen Mid-Winter Webinar 2025: How do you managing the Unmanageable Without Imploding? Great event for a wahine founders coming up next week. This year’s TechWomen Mid-Winter Webinar brings together council members for an honest virtual kōrero on navigating the highs and lows of the tech world — from returning to work after big life changes to embracing neurodiversity and speaking on the global stage. Open to all, this session is a chance to hear real stories, ask big questions, and connect through shared experiences.

What they’ll explore:

Highs & Lows: Returning back to work – Eva Sherwood Hayter

Opportunity & Growth: Speaking at APEC to influence changing policies for more equitable workplace – Samar Alrayyes

The healing journey: Our Voice Matters – Amanda Watson

The healing journey: Neurodiversity and leading with openness – Sasha Mullins

Cautionary Tale: Self-discovery and tackling employment – Vanessa Leite

Navigating Change: Growth of Transitioning into tech – Isabell Brinsley-Pirie

Navigating Change: Handling the hype of AI – Amanda Veldman

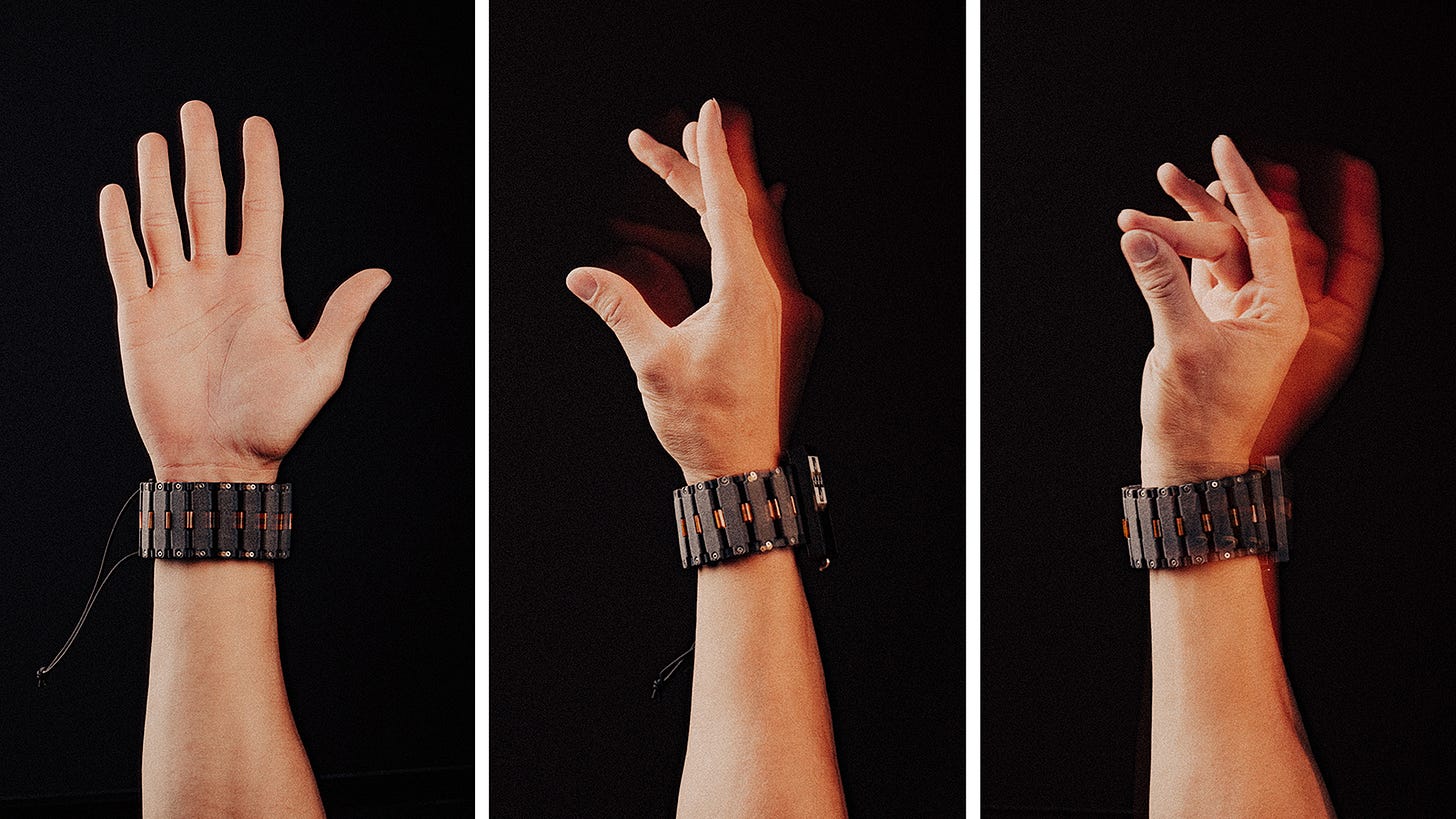

Meta is researching a wristband which can control devices through gestures: If you’re a millennial nerd like me chances are high you have seen the Tom Cruise film ‘Minority Report’ which did you lasting damage by giving you a vision of motion controlled computing technology that felt real enough to touch. Well, that dream might finally be coming true. Meta researchers have teamed up with Carnegie Mellon to work on a gesture based device, initially focused on assisting people with spinal cord injuries control their technology more intuitively. Read the full report here.

That’s it for today, thanks for reading. Want to get in touch with a news tip, bit of feedback or just to chat? Email hello@caffeinedaily.co